From Vox

Summary

Home insurance is increasingly becoming unaffordable and difficult to obtain due to rising premiums driven by natural disasters, inflation, and regulatory challenges. Climate change exacerbates these issues, leading to a surge in insured losses and prompting insurers to reevaluate their risk models. As catastrophes like hurricanes become more common, many homeowners face tough choices regarding coverage. The future of home insurance is uncertain, with potential solutions requiring significant changes in regulations and risk management strategies.

Highlights

- 🌪️ Rising Premiums: Home insurance premiums have surged across the U.S., particularly in high-risk states like Florida.

- 🏠 Insurance Availability: Many homeowners are struggling to find insurance as private companies exit high-risk states.

- 💰 Insured Losses: Global insured losses from natural disasters topped $60 billion in the first half of 2024, significantly higher than the historical average.

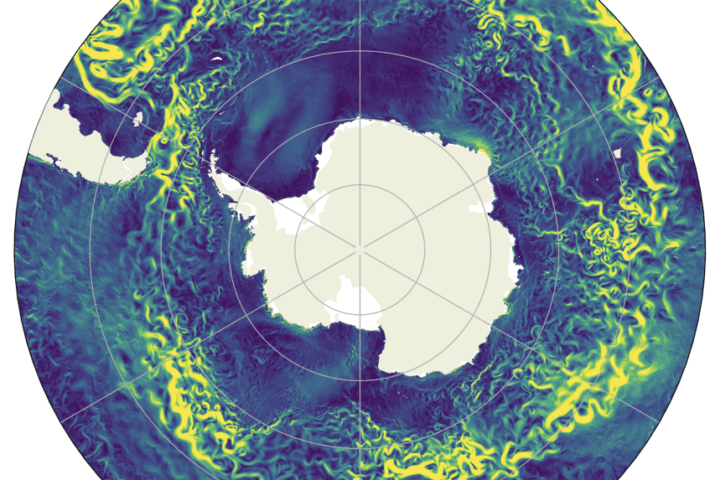

- 🌍 Climate Change Impact: Insurers are grappling with the implications of climate change on risk assessment and pricing.

- 🏛️ Regulatory Challenges: Increased litigation and regulatory limitations are further complicating the insurance landscape.

- 📈 Profitability of Insurers: Despite rising risks, insurance companies have reported record profits, highlighting a disconnect with consumers’ struggles.

- 🔍 Future Uncertainty: The insurance industry’s ability to adapt to climate challenges remains uncertain, with calls for systemic changes.

Insured losses from natural disasters around the world in the first half of the year have already topped $60 billion, 54 percent higher than the 10-year average. Three-quarters of insured losses were due to severe thunderstorms, flooding, and forest fires. More recent calamities like Hurricane Helene will push the toll this year much higher. Damage estimates for Helene ranged as high as $47.5 billion as of October 4.

Home insurance premiums are rising across the country. Florida homeowners already pay the highest rates, on average more than $10,000 per year, well above the national average of around $2,400 per year. Last year, US home insurance rates jumped 11.3 percent on average, which has led some to drop their coverage altogether. Some Floridians have seen rate hikes as high as 400 percent over the past five years.

That’s if they can find insurance at all. Hundreds of thousands of Americans have come home to a breakup letter from their private insurers, canceling their coverage. Others can’t find any company that will protect their home, leaving expensive, state-run insurers of last resort as their only option. Some private insurance companies have entirely pulled out of states like California, Florida, and Louisiana.

Meanwhile, the National Flood Insurance Program (NFIP), a federal program that provides flood coverage to 4.7 million policyholders, is more than $20 billion in debt to the US Treasury accruing $1.7 million in interest daily. In September, Congress reauthorized the program for a few months. The next funding deadline is December 20, 2024. If authorization lapses, the NFIP would stop selling and renewing flood insurance for millions of people.

[...]